Revisiting Municipal Bonds

As the overall economy showed signs of improvement in the fourth quarter of 2010 and into 2011, the municipal bond market continued to struggle.

An increase in mutual fund redemptions that drove prices lower was caused in part by relentless negative media attention regarding credit ratings and potential defaults. Investor fear was fueled by Wall Street analyst Meredith Whitney’s 60 Minutes appearance in December where she commented, "You could see 50 sizable defaults. Fifty to one hundred sizable defaults. More. This will amount to hundreds of billions of dollars worth of defaults." As the press piled on, increasing the fear of defaults, prices in the fourth quarter suffered their worst decline in 16 years.

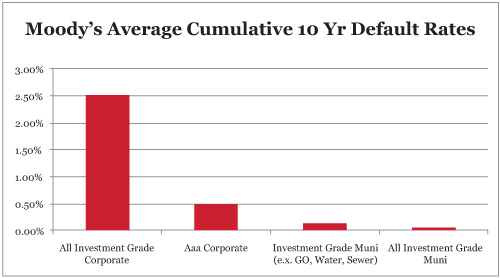

However, given the historically low default rates in municipal bonds (as illustrated below) as well as their ability to diversify risk and improve after tax return in portfolios, it is an especially important time to revisit municipal bonds. Bonds, like any investment strategy, carry risk and require skill and discipline when committing funds into the market.

Source: Moody’s via Breckinridge Capital Advisors.

One of the most attractive features of municipal bonds is the exemption of their interest payments from regular federal income taxes. Muni bonds can be purchased that are also exempt from federal alternative minimum tax (AMT); and most state and local governments will not impose tax on municipal bond interest paid on their own bonds. In early February, the average yield on the 20 long-term munis that make up the Bond Buyer index was 5.3%. An investor in the 35% federal income tax bracket would need to earn 8.1% interest from a taxable bond to get an equivalent return. At the time, 30-year Treasury bonds were yielding 4.5% (April, Kiplinger Personal Finance). If individual tax rates increase, the tax benefit of owning municipal bonds will only improve.

Muni bond pricing, for both short and long maturities, has become more attractive with the increased fear over state finances and credit ratings. The increased sales pressure on municipal bonds has caused yields to rise (yields move inversely to price of bonds). However, as noted in the chart, muni issuers rarely default. This is due in part because public entities have the power to tax in order to meet interest and principal payments. For many states, payment of general obligation bonds is a constitutional priority. Some astute investors (including Pimco’s Bill Gross) are buying municipal tax-free bonds in taxable bond funds because of the relative attractiveness in the current marketplace.

Municipal bonds, like other interest bearing bonds, are sensitive to both rising interest rates and inflation. Whether investing via mutual funds or buying individual bonds, it is critical for an investor to understand interest risk, time horizon and duration. Duration is the measure of a bond or bond fund’s sensitivity to interest rate shifts (rising and falling). In uncertain times such as these, many professional money managers will manage interest rates and reinvestment risk by minimizing duration. If a fund has an average duration of 5 years, it means that its price of the fund should move about 5% for every 1% move in interest rates. The lower the duration, the less sensitive the portfolio to interest rate movements. The average duration for most mutual bond funds is published by Morningstar.

Individual or self-directed investors often employ "buy and hold" or, a laddered bond strategy. Unfortunately, individuals buying municipal bonds are often subject to thin and/or inefficient markets. In short, they may experience poor pricing or mark-ups because they lack the purchasing power of larger institutional investors—one potential benefit of hiring a professional money manager. Individuals should inquire about any mark-ups on bonds and the opportunity to participate in block pricing. For more information on recent municipal bond trades and pricing, please see the site www.investinginbonds.com.

Another potential benefit of utilizing an institutional or professional money manager to invest in municipal bonds is they typically will employ a full team of credit analysts to further research a specific municipality’s ability to make interest and principal payments. Given the current market conditions, detailed credit research and analysis of the specific issue and issuer is critical.

Bonds are an integral part of a well balanced asset allocation strategy. Each class of bonds from corporate to mortgage-backed to U.S. treasury bonds has unique risk/return characteristics and benefits to an investor. Municipal bonds can diversify your portfolio and provide federally tax-free income, the latter being a unique quality to municipal bonds. Like any investment being reviewed for inclusion in your portfolio, it is important to understand the reason for investing in municipal bonds, how they might fit into your portfolio, the time horizon for holding them, and the most effective way to access them. A lot of market noise surrounds municipal bonds at the current time (which can serve to create appealing opportunities for investors). We suggest revisiting the fundamentals of municipal bonds with your advisors to decide if they are an appropriate strategy for you.